doordash quarterly tax payments

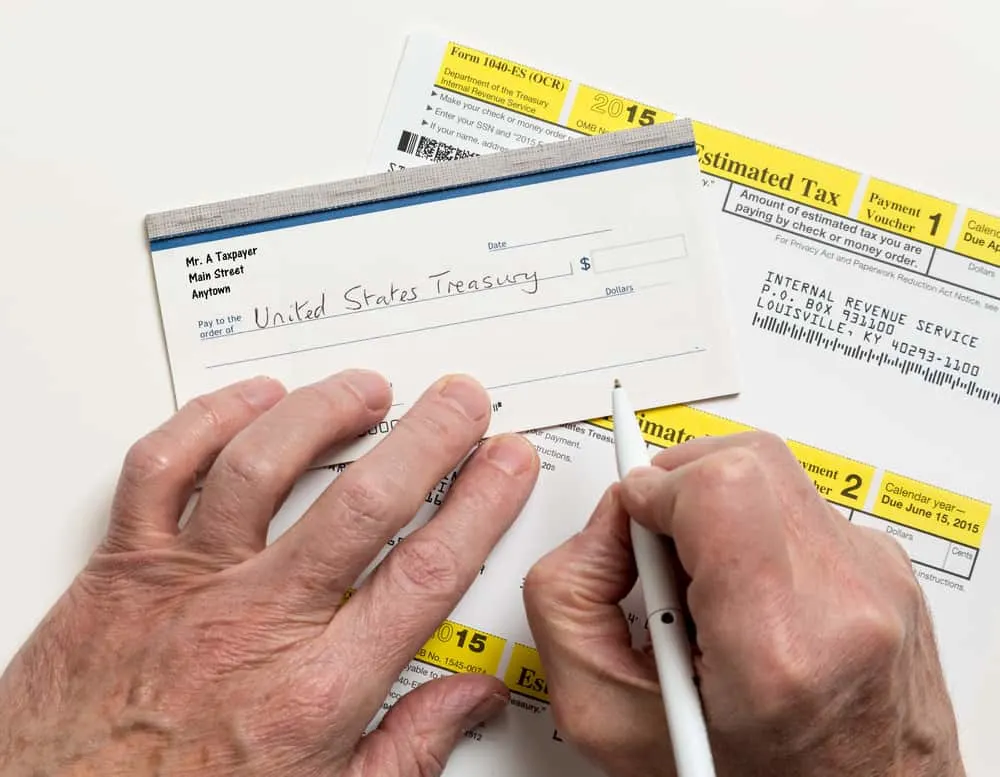

100 of prior year taxes. DoorDash will issue a 1099.

Pin By Mae On Ha Ha In 2022 Memes For Him Words Memes

Paying quarterly taxes which arent actually quarterly by the way takes literally 30 seconds.

. Make sure to pay estimated taxes on time. 110 of prior year taxes. Do I have to pay DoorDash taxes quarterly.

But if filing electronically the deadline is March 31st. The amount youll pay for the. Fire Inspections Safety Permits.

April 1 May 31. The standard FUTA tax rate is currently 60 on the first 7000 of taxable wages per employee which means that the maximum tax employers have to pay per employee per tax. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

Dude if you only made 1000 all year I wouldnt even mess with quarterly taxes. From National Restaurants to Local Favorites DoorDash delivers the top restaurants. You can unsubscribe to any of the.

Ad Order right now and have your favorite meals at your door in minutes with DoorDash. Your late fee is gonna be like 10 if that lol. Internal Revenue Service IRS and if required state tax departments.

If youre purely dashing as a side hustle you might only have to pay taxes one a year. A 1099-NEC form summarizes Dashers earnings as independent. Dasher 1 year.

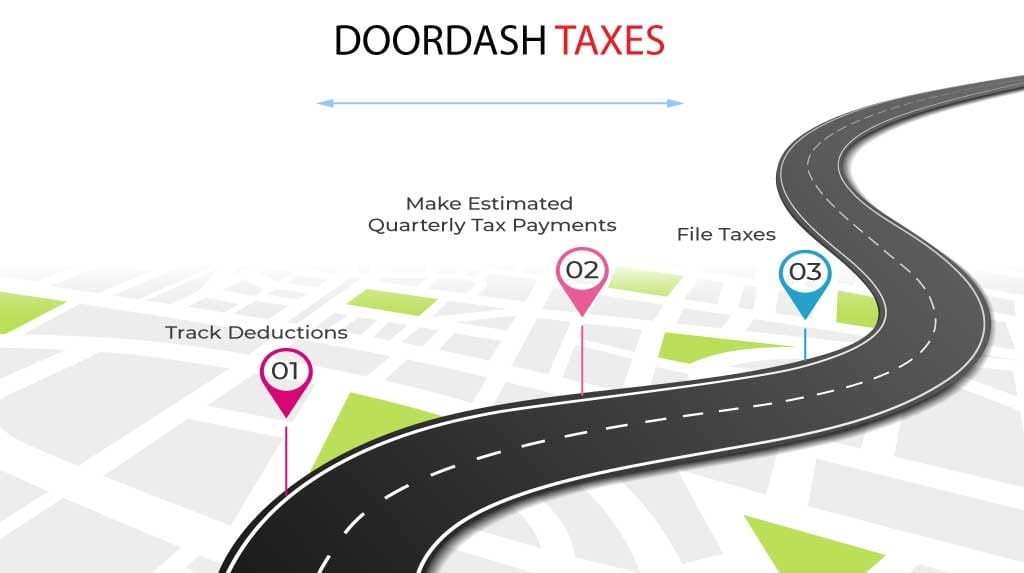

February 28 -- Mail 1099-K forms to the IRS. The second penalty youll pay for not filing your DoorDash taxes is for Failure to Pay. Each quarter youre expected to pay taxes for that quarters payment period.

From National Restaurants to Local Favorites DoorDash delivers the top restaurants. AGI over 150000 75000 if married filing separate 100 of current year taxes. How Does Doordash Taxes Work.

Press Command Shift N. Fire Prevention Home Safety. You must make quarterly estimated tax payments for the current.

4d edited 4d. How to Pay Doordash Taxes. Press Ctrl Shift P.

How To Pay Quarterly Taxes. There are no tax deductions or any of that to make it complicated. Third Quarter Estimated Tax Payment Due.

Since youre an independent contractor you might be responsible for estimated quarterly taxes. 90 of current year taxes. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year.

Press Ctrl Shift N. How Much Tax Does Doordash Charge. Tax payment is due June 15 2021.

Do you owe quarterly taxes. Technically both employees and independent contractors. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

The forms are filed with the US. Instructions for doing that are available through the IRS using form 1040-ES. Solution found Its a straight 153 on every dollar you earn.

January 31 -- Send 1099 form to recipients. Instead you must pay them yourself at tax time or if you make enough by making estimated tax payments throughout the. The self-employment tax is your Medicare and Social Security tax which totals 1530.

March 31 -- E-File 1099-K forms with the IRS. Answer 1 of 4. Ad Order right now and have your favorite meals at your door in minutes with DoorDash.

If youre in the 12 tax bracket every 100 in expenses. Here are the due dates for 2021. Well You estimate the taxes that will be owing on your earnings.

You can also use the IRS website. Here are the keyboard shortcuts to open a private window. Up to 8 cash back At DoorDash we promise to treat your data with respect and will not share your information with any third party.

As such DoorDash doesnt withhold the taxes for you. From flexible work hours to not reporting to a boss being self-employed comes. In spite of not getting a W-2 your income tax filing process wont differ much from those with traditional employment.

Dashers will not have their income withheld by the company to pay for these taxes so.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

Doordash 1099 Critical Doordash Tax Information For 2022

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How To Do Taxes For Doordash Drivers 2020 Youtube

How Much Do People Actually Make From Gigs Like Uber And Airbnb Sharing Economy Financial Aid For College Financial Aid

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash S 3 Laws Of Deception I List Out 3 Ways In Which Doordash By Rahul G Medium

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do I File Doordash Quarterly Taxes Due Septemb